- ...

- Day Insurance

Driving Licence Types

Driving licence codes explained

- From 1-28 days. You only pay for the cover you want and only when you need it.

- Drive away cover while waiting for your annual policy.

- Protects your no claims discount. Fully comp insurance for peace of mind.

For the majority of drivers, the type of driving licence you hold will depend on whether you’ve passed your driving test. You need a provisional driving licence while learning to drive and once you’ve passed, you can apply for your full driving licence. It’s not always this simple…

Whether you drive a car, a motorbike or even a larger vehicle, there are several different driving licence types you could have. Each one has a big impact on what kind of insurance (including temporary car insurance) you can get and how much you will have to pay.

What is a full UK driving licence?

Once you have passed your theory test and practical driving test, you will have two years to apply for a full UK licence. This pink photocard licence entitles you to drive anywhere, at any time, without supervision.

Drivers with a full licence can drive either a manual or automatic vehicle. If you have an automatic driving licence, you will only be able to drive cars with automatic gearboxes. If you want to upgrade to a manual driving licence, you’ll have to pass a driving test in a manual car.

Drivers must renew their licence every 10 years until they reach 70 years old. Once you turn 70, you will have to renew your licence every three years. This is more of an administrative process that lets drivers of this age update their photographs. There’s no need to retake any test.

You must disclose what driving licence type you have when applying for insurance. A full UK licence is the minimum requirement for most insurers. If you don’t have this, you must apply for specialist insurance depending on what type of licence you have.

If you hold a full driving licence, you will be able to get an annual or temporary car insurance policy. Please note there are some restrictions based on any previous driving penalties. You will find that how long you’ve held your licence and other factors including your address and vehicle type, may affect how much you pay.

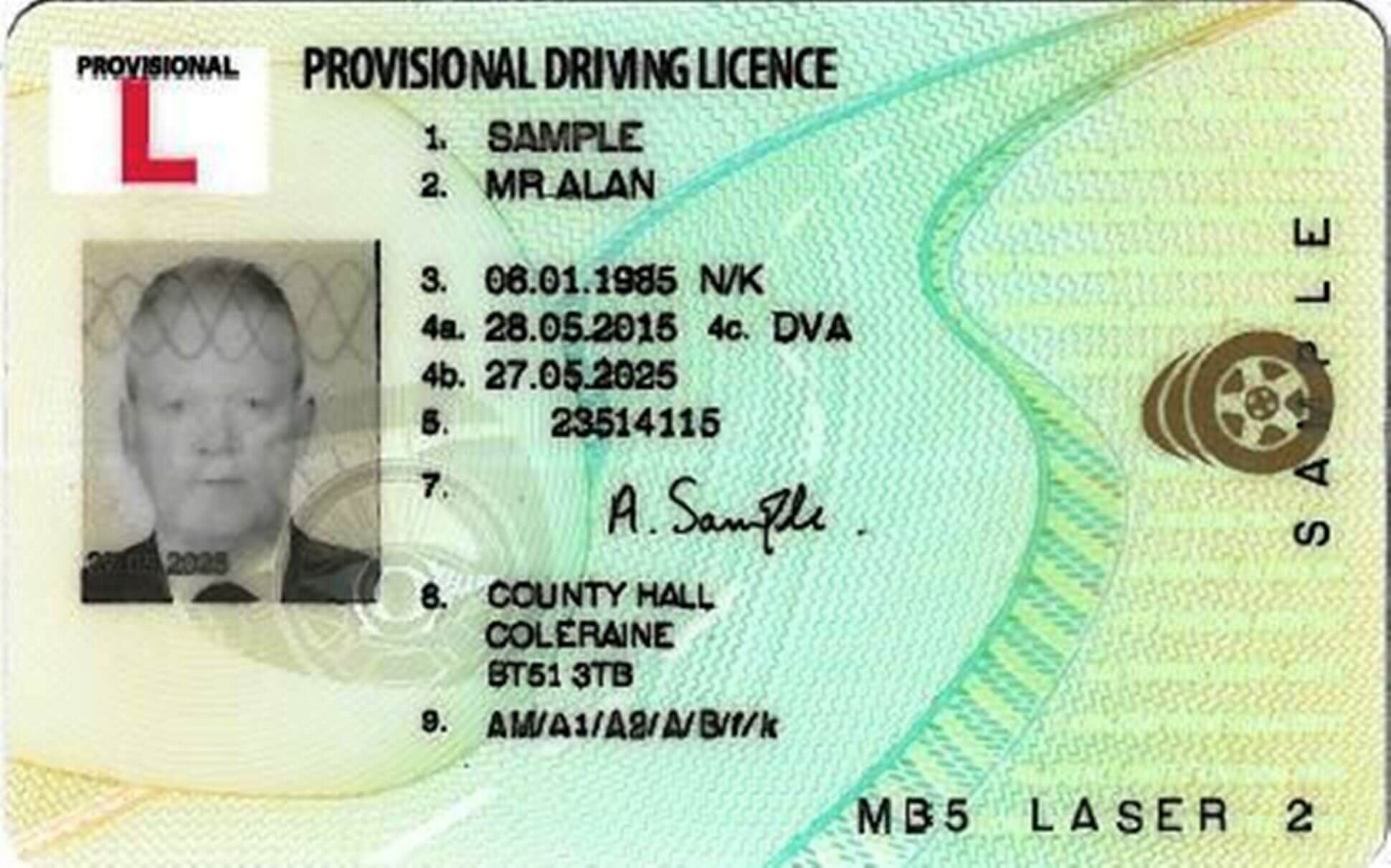

How to apply for a provisional driving licence

Some people apply for a provisional driving licence as a form of I.D. but the majority do so they can start learning to drive.

Until you pass your practical test, you will have a green provisional licence. This means that any time you are on the road, you must be supervised by a driver who meets the following requirements:

- They must be a qualified driving instructor

- They must be a qualified driver (e.g. a friend or family member) if you’re driving in a private car

- Be aged over 21 (25 if supervising you on Tempcover’s temporary learner driver insurance policy).

- Hold a full UK driving licence and have held that licence for at least 3 years.

- Have been a permanent UK resident for at least 2 years

Having a provisional licence can mean you may have to pay a large insurance premium because of the lack of experience and increased risk provisional drivers pose.

If you’re learning without a qualified instructor, you must make sure you are properly insured to do so. One way to do this is with Tempcover’s temporary learner driver insurance. Easy to arrange and available from 12 hours up to 28 days, this is a comprehensive policy that helps learners get some extra practice in while they get to grips with driving a car.

It also provides the vehicle owner with greater peace of mind, as it protects their no claims discount. As it’s a separate policy, the owner’s premiums won’t increase because a provisional licence holder is learning in the car, even if the worst happens and they do have an accident.

What is a full EU driving licence?

The European driving licence, created in 2013 to replace the growing number of licence types within the EU, can be used to drive in all EU nations as well as Iceland, Liechtenstein and Norway.

- If you’re visiting the UK, you will be able to purchase insurance to cover you while you’re here. For temporary trips like holidays and visiting family, temporary car insurance is perfect as you only have to pay for the duration of your trip and you’re not restricted because of your licence.

- If you have moved to the UK permanently, you will be able to use your full EU licence until it expires.

- If you are younger than 67 when you become a resident, you can drive on your licence until you’re 70. If you are 67 or older, you can use your EU licence for three years from the date you become a resident. At that time you’ll be able to exchange it for a UK licence.

Whatever your licence type, there’s a temporary insurance policy to suit your needs. So whether you’re a learner who wants to be insured to practise in your parent’s car, an EU driver looking for car insurance while on holiday or just need to borrow a car from a friend, short-term insurance is the flexible solution to many everyday insurance headaches.

What are the driving licence codes?

These are the vehicles you can drive as soon as you get a full licence.

A1 – Motorbike (engine of up to 125cc)

AM – 2 or 3-wheeled vehicles and light quad bikes You can drive a 2 or 3-wheeled vehicle with a maximum speed of more than 15.5mph, but not more than 28mph. You also can ride a light quad bike with an unladen mass of not more than 350kg not including batteries.

B – Cars (Max 8 passenger seats)

B auto – Automatic cars only

BE – Cars and trailers (up to 3500kg in MAM)

B1 – 4-wheeled vehicles (up to 550kg if carrying goods)

f – Agricultural tractor

k – Mowing machine or pedestrian-controlled vehicle

q – 2 or 3-wheeled vehicles (engine size more than 50cc and top speed of 15.5mph)

Category B licences

If you passed your test before 1 January 1997, you can drive a 4-wheel vehicle and trailer combination with a maximum authorised mass (MAM) of 8,250kg. If you passed on or after 1 January 1997, you can drive vehicles up to 3,500kg MAM, with up to 8 passenger seats, plus a trailer up to 750kg.

Other driving licence categories

You may want to update your driving licence so that you can drive other vehicles for work or leisure purposes. These categories include:

C – Large vehicles (over 3500kg with a trailer up to 750kg MAM)

CE – Large vehicles (with a trailer over 750kg)

D1 – Minibuses up to 8 metres long, with no more than 16 passenger seats, plus a trailer of up to 750kg

h – Tracked vehicles including former military vehicles

L – Electrically-propelled vehicles

m – Trolley vehicles

Digital driving licences – coming soon

According to government data, there are more than 34 million full driving licence holders in England alone. Later on in 2025, they’ll be able to add voluntary digital driving licences to a new government smartphone app. As well as proving you’re qualified to drive and making it easier to find your driving licence number, the digital driving licence is also due to be accepted as a form of ID when buying alcohol, voting, or boarding domestic flights.

Tempcover It!

Once you’ve got your driving licence, you’re going to want to get behind the wheel of a car. Arranging an annual policy can be a time-consuming effort, so why not get temporary car insurance so you can get the car home and drive in those first few days while arranging your annual cover.

Customer Satisfaction

We also currently hold an ‘Excellent’ rating on Trustpilot with over 40,000 reviews.

We’ve been recognised for our work with plenty of awards

We work directly with insurers to provide you with short-term insurance to suit your needs

You can pay for your short term insurance policy in several ways. Using our secure payment system, you can use the following payment methods:

After you’ve bought your policy, your documents will be emailed to you instantly so there’s no waiting around.

The cover you need for the duration you want

Full cover, no impact

Get fully comprehensive cover on our standard short term policies - plus it won't affect your no claims discount

Hourly, daily, weekly

Choose the duration you want with 1-12 hour and 1-28 day cover available - don't pay for cover you don't need

All customised, nothing added

Customise your policy to suit your specific situation - get the policy you want and even choose the minute you want your policy to begin